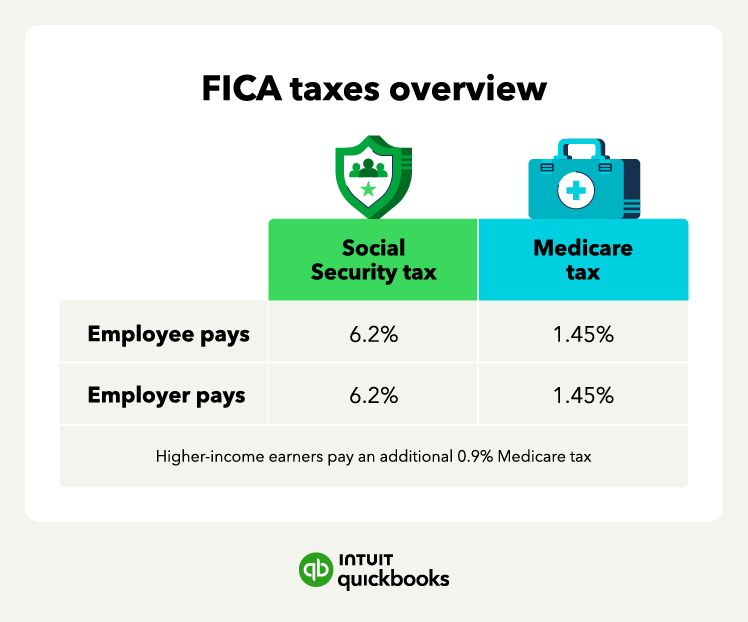

Fica And Medicare Tax Rate 2025. Employers and employees each pay 6.2 percent of wages up to the taxable maximum of $168,600 for 2025. [3] there is an additional.

You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. Fica taxes include both social security and medicare taxes.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.

Understanding FICA, Social Security, and Medicare Taxes, Social security tax (6.2% of wages, up to a maximum taxable income) and medicare tax (1.45% of wages, with no income limit). 1.45% for the employee plus.

What are FICA taxes? Rates and calculations QuickBooks, The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025. The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.

What is FICA Tax? Intuit TurboTax Blog, Social security taxes are the 6.2% taken out of your paycheck each month (up to $168,600, the 2025 taxable maximum) while fica refers to the combination of. The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55 percent.

How To Deduct Social Security Tax And Medicare Tax, For 2025, the fica tax rate for both employers and employees is 7.65% (6.2% for oasdi and 1.45% for medicare). The federal government sets a limit on how much of your income is subject to the social security tax.

New 2025 Social Security, FICA and Medicare Tax Update Ineo Site, 6.2% goes toward social security tax and 1.45% goes toward medicare tax, which helps fund benefits for children, retirees and the disabled. The additional medicare tax of.9% applies to earned.

What Is The Cap On Medicare Payroll Taxes, The social security wage cap will be increased from. As of 2025, employers and employees each pay 6.2% for social.

What Are FICA Taxes? Forbes Advisor, In 2025, only the first $168,600 of your earnings are subject to the social security tax. How much is the fica tax;

Tax Brackets 2025 Federal Married Myrle Tootsie, The 2025 medicare tax rate is 2.9%. The budget proposes to increase the medicare tax rate on earned and unearned income above $400,000 from 3.8 percent to 5 percent.

FICA explained What to know about Social Security, Medicare tax rates, As these forms were enabled at the start of april 2025, many taxpayers, including salaried ones, started filing their income tax returns for assessment year 2025. In 2025, the medicare tax rate is 2.9%, with half (1.45%) paid by the employee and the other half (1.45%) paid by the employer.

2025 Fica And Fica Medical Rates, You’re typically responsible for paying half of this amount (1.45%), and your employer is responsible for the other half. The fica tax rate, which is the combined social security rate of 6.2 percent and the medicare rate of 1.45 percent, remains 7.65 percent for 2025 (or 8.55 percent.