How Much 401k 2025. Employees can invest more money. In 2025, the 401 (k) contribution limit for participants is increasing to $23,000, up from $22,500 in 2025.

This gives you even more room to stash away money. The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025).

As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

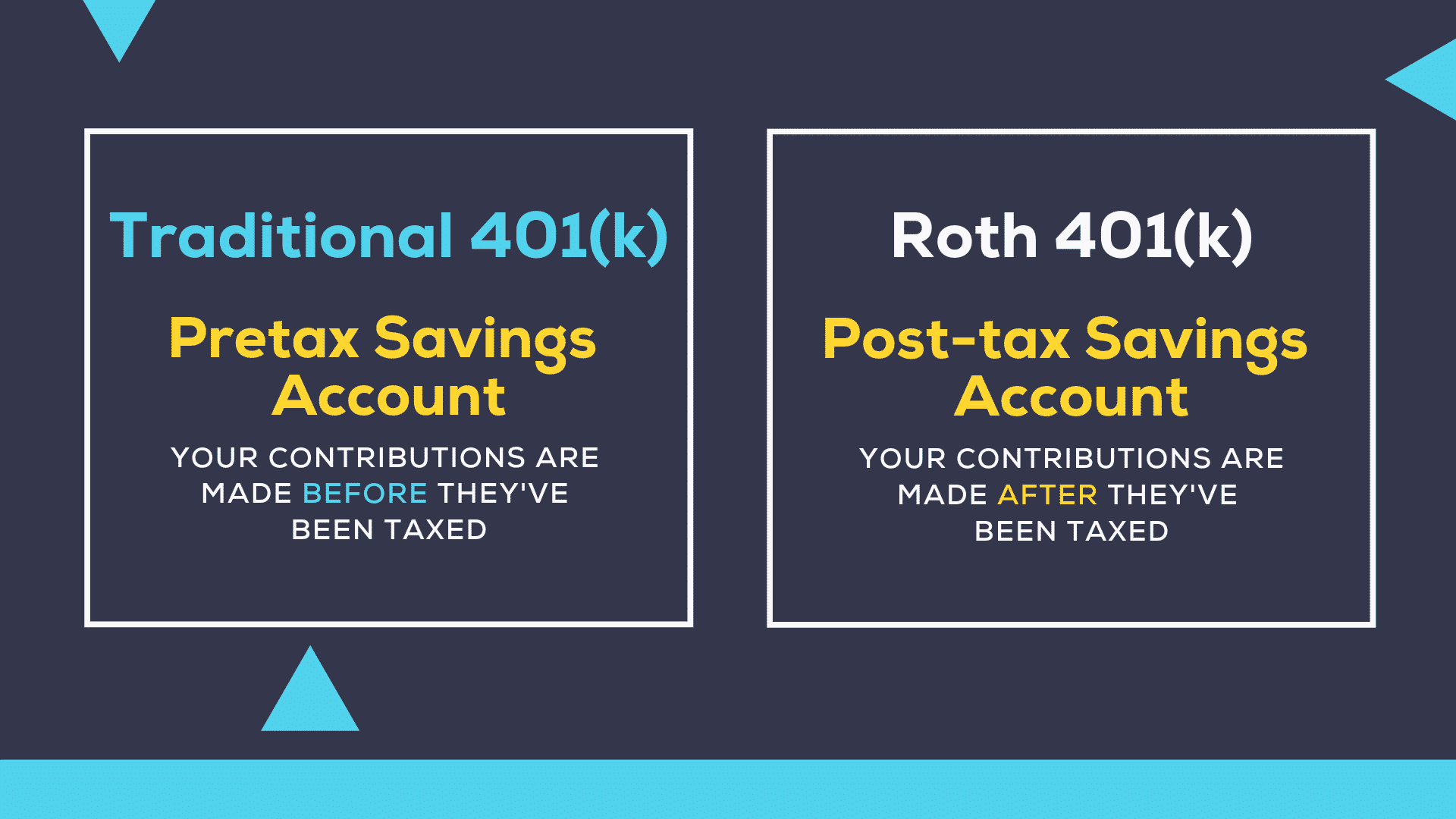

Whats The 401k Max For 2025 Brynn Corabel, The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025). The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

How Much Should I Have Saved In My 401k By Age?, The maximum amount an individual can contribute to their 401 (k) plan is now $23,000, an increase from the previous year's limit of $22,500. As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

2025 Max Employee 401k Contribution Cari Marsha, This amount is up modestly from 2025, when the individual 401. You can contribute to more than one 401 (k) plan.

Tax Rules 2025 Retha Martguerita, The irs has increased the contribution limits for 401 (k) plans in 2025 to $23,000, up from $22,500 in 2025. The basic employee contribution limit for 2025 is $23,000 ($22,500 for 2025).

401k vs roth ira calculator Choosing Your Gold IRA, The 2025 401 (k) contribution limit is $23,000, a $500 increase from 2025’s limit. Retirement savers are eligible to put $500 more in a 401 (k) plan in 2025:

The Maximum 401(k) Contribution Limit For 2025, Maximize your 401k contributions in 2025: The combined annual contribution limit for roth and traditional iras for the 2025 tax year is $7,000, or $8,000 if you're age 50 or older.

Federal 401k Contribution Limit 2025 Gaby Pansie, Maximize your 401k contributions in 2025: As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.

What’s the Maximum 401k Contribution Limit in 2025? (2025), The 401 (k) contribution limit for 2025 is $23,000. New updates to the 2025 and 2025 401k contribution limits.

401k 2025 Changes Tatum Gabriela, If you’re 50 or older, you can stash an additional $7,500 in your 401 (k). The irs has increased the contribution limits for 401 (k) plans in 2025 to $23,000, up from $22,500 in 2025.

401k 2025 Contribution Limit Chart, This limit includes all elective employee salary deferrals and any contributions made to a. As of 2025, individual employees have a 401 (k) contribution limit of $22,500, allowing them to contribute this amount annually to their 401 (k) account on a.